vendredi 8 avril 2011

Dans les nuages...

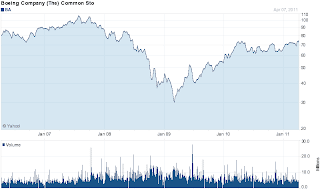

BA.nyse Allons-nous voir un retour au niveau de 2007 ?

jeudi 7 avril 2011

" l'alternative au iPad "

SIRI.nasdaq

mercredi 6 avril 2011

Portugacabado

百事可乐

> iPad 3

shale gas

mardi 5 avril 2011

c'est tranquille.....

Wall Street closed its books Tuesday on another day of thin trading volume, as investors appeared unwilling to make any big moves ahead of upcoming earnings season. Tuesday’s New York Stock Exchange volume of 831 million shares represented 82% of the 30-day average. Composite volume was 3.9 billion, or 92% of the last month’s average, according to FactSet. In the prior session, both volume trackers were at their lowest since New Year’s Eve.

CSCO.nasdaq

John Chambers, in a memo to Cisco employees is promising some big changes to repair the technology company’s credibility after a series of disappointing earnings reports, Bloomberg reported today. That could be good news for Cisco shares, which have suffered during the past year.

Despite the disappointments, Cisco is hugely profitable, sits on a $40 billion cash pile and otherwise has strong fundamentals, and now trades at about 13 times trailing earnings, which is historically low for the company.Stronger Cisco sales growth is what the market wants. As a manufacturer with fixed costs, as sales rise profits rise more swiftly. But Chambers hasn’t delivered the growth yet. “You will see Cisco make a number of targeted moves in the coming weeks,” Bloomberg quoted Chambers as promising. With his vow public, that will put pressure on Cisco to perform, and that could help the stock. Charts Pro finds the shares undervalued.

Les banques centrales doivent concentrer leurs efforts sur la maîtrise de l'inflation alors que la reprise économique commence à s'installer durablement, a souligné mardi l'Organisation de coopération et de développement économiques. L'OCDE estime que si la reprise commence à prendre son autonomie, les banques centrales de certains de ses membres sont sous la menace d'un "désancrage" de l'inflation. "Nous percevons des anticipations inflationnistes qui se faufilent un peu partout. Je dirais en Europe, aux Etats-Unis , au Canada et au Royaume Uni", a déclaré dans un entretien Pier Carlo Padoan, chef économiste.

lundi 4 avril 2011

MCDONALD'S veut recruter jusqu'à 50 000 personnes aux Etats-Unis

C.nyse